Wireless

DOCSIS® Network vs. Fiber Backhaul for Outdoor Small Cells: How Larger Footprint of DOCSIS Networks Lowers TCO in the Outdoor Use Case

In our recent blog post, we talked about how, from a total cost of ownership (TCO) perspective, DOCSIS networks triumph as either backhaul or fronthaul over traditional fiber backhaul for the indoor use case. In this blog, we bring that TCO analysis to a more intuitive, outdoor use case: a head-to-head comparison between TCO of DOCSIS backhaul and fiber backhaul, both of which serve the same set of outdoor small cells.

The basic idea here is: leverage the existing real estate of DOCSIS networks for additional use cases beyond residential/business services. This approach applies to the markets where DOCSIS networks already have a larger footprint than the fiber on the ground. We have seen data points suggesting that there typically is 3~5X more coax cable than fiber in major North American metro markets. This enables a large subset of small cells to be deployed on cable strands or at a short distance from the cable strands, using short drops.

Through primary research, one of our members with dual operations (cable + wireless) confirmed that from a small cell radio planning perspective, they exhaust all cable strand mounting options first, before looking into the gaps for additional sites. This is the key differentiator for DOCSIS technology vs. fiber, where most of the backhaul connections require either new build or premium lease rates.

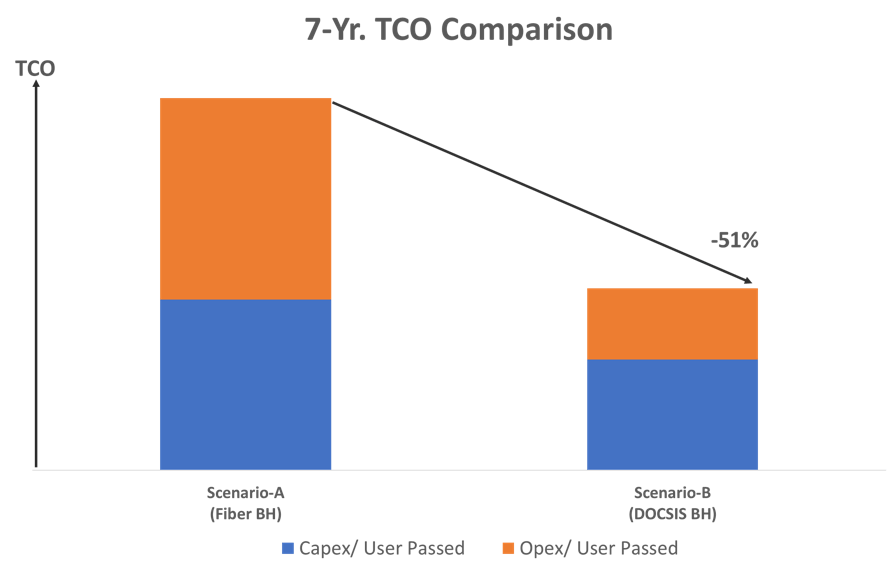

In this TCO analysis, we showed >50% reduction in TCO for an outdoor use case of backhauling small cells when served by DOCSIS networks compared to a more traditional deployment served by fiber.

But, Is DOCSIS Network the Right Solution for Small Cell Backhauling?

The short answer is – YES.

There are two major requirements associated with any small cell deployment –

- Site acquisition/preparation/construction/powering

- Backhaul with certain capacity/latency/timing synchronization

These two requirements are intertwined since we need to choose a site where backhauling option/s are available and, to the extent possible, cost-effective.

In terms of site (1st requirement) with ready access to backhaul, MSOs have 2 offers on the card:

- Firstly, co-siting small cells with existing MSO owned/operated WiFi hotspots which are already served by DOCSIS backhaul.

- Secondly, leveraging existing cable infrastructure, and in particular aerial plant i.e., cable strands, that takes out a lot of steps (and cost) from the small cell deployment process. Using existing infrastructure eliminates/lightens the need for permitting and site acquisition, preparation/construction and also powering. Along with site access (typically covered by existing pole-line attachment agreements) and power, cable strand deployments also come with readily accessible DOCSIS links as backhaul.

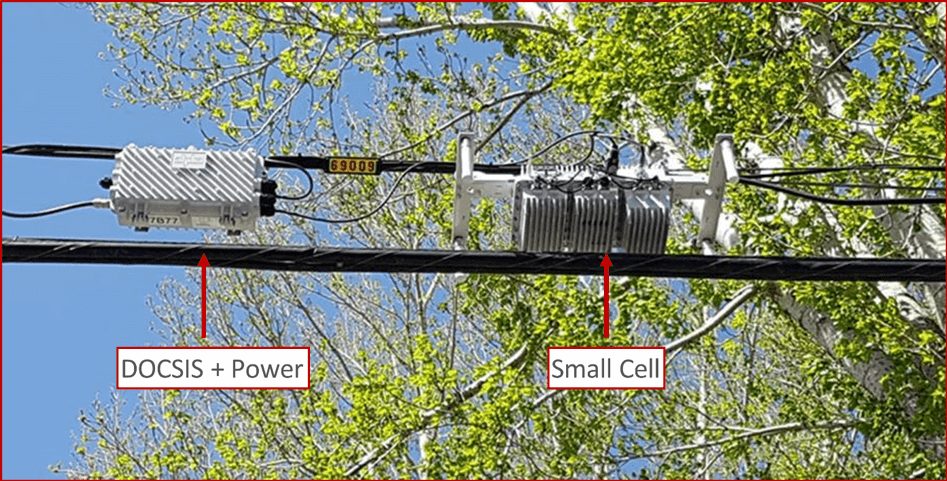

Figure 1 below shows a typical strand-mount small cell installation, consisting of a small cell gateway and a 4G/LTE-A small cell as reported in the technical paper prepared for SCTE-ISBE 2018 Fall Technical Forum by Dave Morley from Shaw Communications Inc./Freedom Mobile. The small cell gateway here contains a DOCSIS 3.1 cable modem and power supply.

Figure 1: Typical Strand Mount Small Cell @ Shaw Communications Inc./Freedom Mobile

In terms of backhaul specifications (2nd requirement), Belal Hamzeh and Jennifer Andreoli-Fang from CableLabs® have articulated how DOCSIS technologies, with recent developments, fulfills all three fundamental backhaul needs around capacity, latency, and timing in the technical brief titled DOCSIS Technologies for Mobile Backhaul (CableLabs members only). In that paper, the authors have argued that, depending on the mobile operator’s defined SLA, even DOCSIS 3.0 can support backhaul capacity needs. And, significant downstream capacity improvement can be added with DOCSIS 3.1 and significant upstream capacity improvement can be added with Full Duplex DOCSIS.

Regarding latency, control and user plane latency is expected to improve significantly, achieving ~1-2ms latency with the pipelining/Bandwidth Report (BWR) technique across DOCSIS and mobile technologies. Finally, DOCSIS 3.1 already has the mechanism to natively distribute IEEE-1588 timing over the network. With recent CableLabs work on a DOCSIS synchronization specification, DOCSIS 3.1 will also be able to achieve the stringent phase precision as required in LTE TDD/5G networks.

Therefore, in summary, DOCSIS meets the requirements associated with small cell deployment, triggering the need to compare its TCO with traditional fiber based TCO when either one can provide the backhaul for a set of newly deployed small cells in a target market.

Deployment Scenarios We Looked At

For TCO analysis, we considered a hypothetical market covering 100 sq.km. with 290K housing units (HU) and ~700K people in it. There will be 640 outdoor small cells deployed in the market with 150Mbps/50Mbps max DL/UL throughput per cell (20MHz 2*2 LTE cell). For simplicity, using 1:1 mapping between radio and backhaul throughput, we considered peak backhaul capacity of 150Mbps/50Mbps per small cell.

However, since the peak data rates are required/achieved only under ideal conditions, the average DL/UL throughput during the busy hour is much lower, typically 20-25% of the peak rates. We considered the average throughput to be 20% of the peak, thus forming a small cell cluster comprised of 5 small cells that results in 128 total small cell clusters in our market. Each of these clusters is served by a single cable modem capable to handle 150Mbps/50Mbps.

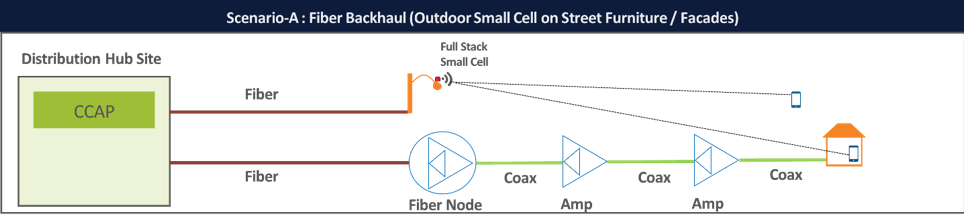

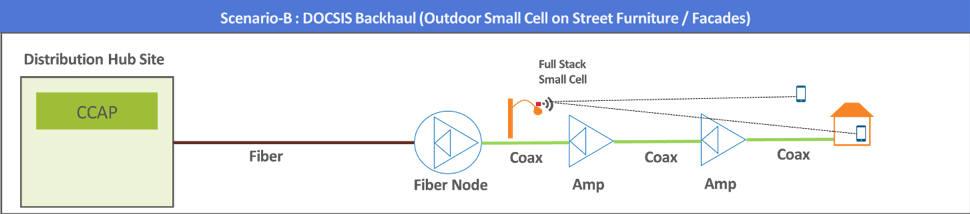

We have 2 identical scenarios: Scenario A, with fiber backhaul and Scenario B, with DOCSIS backhaul, both serving the same market with 128 clusters i.e. 640 total small cells.

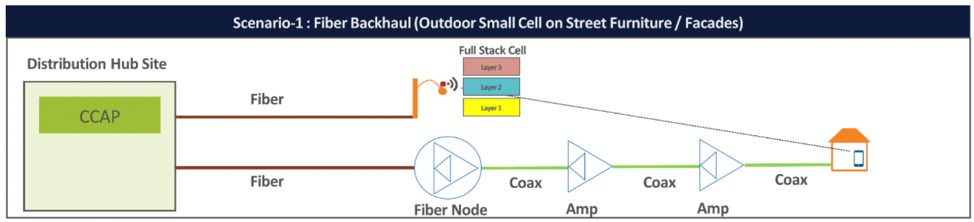

Scenario A: Outdoor small cell served by fiber backhaul

Scenario B: Outdoor small cell served by DOCSIS backhaul

TCO Analysis and Key Takeaways

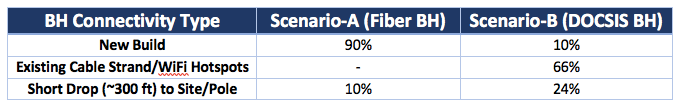

In this analysis, for both scenarios, we assumed the need for 3 types of backhaul connectivity to bring the small cells online – new build (both scenarios), existing cable strand/MSO WiFi Hotspots (scenario B only), and short drop (~300ft) to site/pole from nearby network (both scenarios).

In our base case, for the 2 scenarios, we applied the following breakdown among types of backhaul connectivity required:

Table 1: Backhaul Connectivity Type Distribution Assumed for Base Case

The distribution of backhaul connectivity type used in our base case is informed based on primary research and market observations. Obviously, there is no one size fits all and this is a key area to assess when an operator analyzes potential TCO savings in a target market. Scenario B’s attractiveness largely depends on the ratio (2/3rd in our base case) of existing cable strand/WiFi hotspots that an MSO can leverage to deploy small cells.

The cost difference between new build and short drop does not come from site acquisition/ preparation/ installation because that need will be identical for both types. However, backhaul lease amount (/month) is different for these two types in our 100% Opex based model for backhaul cost.

Though configurable in our model, our default TCO term is 7 years. Also, we calculated the TCO per user passed and focused on the relative difference among scenarios to de-emphasis the overall cost (in dollars), which will differ by markets, the scale of deployment and supplier dynamics among other things.

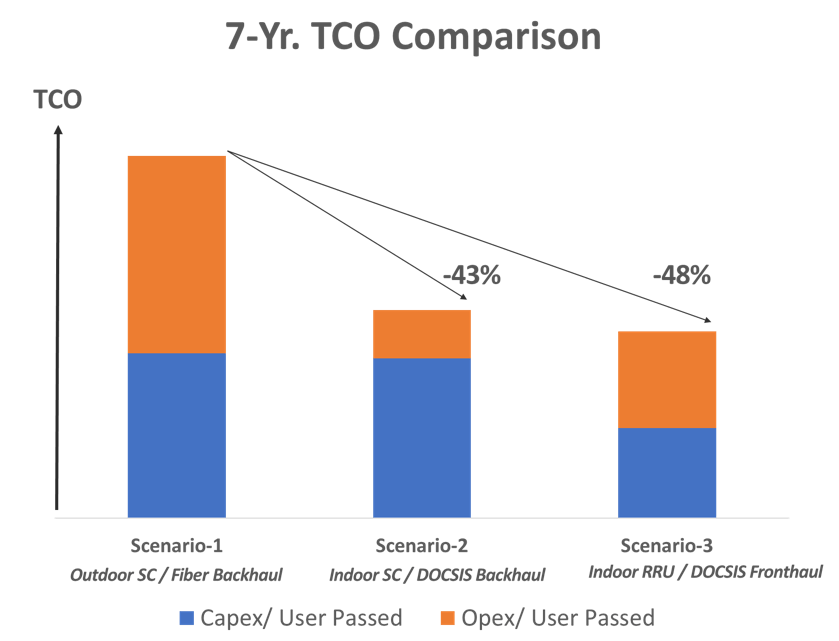

Figure 2: Summary of 7-Yr. TCO between 2 Deployment Scenarios of Outdoor Use Case

According to our base case assumptions, we see the following:

- TCO in DOCSIS BH scenario has the potential to be >50% cheaper than the TCO in fiber BH scenario

- The major difference in TCO between the two scenarios come from Opex. This is because, all 3 key Opex contributors – site lease, site utility cost, and backhaul lease are significantly higher (3~5X) in scenario A than in scenario B.

- There also is a major difference in Capex between the two scenarios. This is largely because, site acquisition/preparation in scenario A costs more (2~2.5X) than the same category of Capex in scenario B, due to the advantage DOCSIS holds for leveraging more existing sites.

- We allocated 20% of DOCSIS network upgrade (from low split to mid split) cost to the DOCSIS scenario. If we take this out (since DOCSIS network upgrades will happen anyway), the Capex associated with plant upgrade cost in scenario B will be gone, making it even more attractive from TCO perspective.

- As mentioned earlier in Table 1, the TCO analysis outcome is primarily dependent on base case assumptions for the distribution of BH connectivity types. If existing cable strand/WiFi hotspots can handle 80% of small cell sites, then, instead of ~50%, the TCO for scenario B will be reduced by ~60%. On the contrary, if that ratio drops down to 50%, then TCO reduction in scenario B will also come down to ~40%.

In an upcoming strategy brief (CableLabs member operators only), we intend to share more details on our methodology, assumptions and breakdown of observed results (both Capex and Opex) along with a full sensitivity analysis.

Conclusion

As we also mentioned in our previous blog (on indoor use case), it’s self-evident that a DOCSIS network-based deployment would have favorable economics compared to a fiber-based model just by virtue of its larger footprint/incumbency alone. When we throw in additional advantages such as lower power requirement/utility charges, that gap only widens. Our TCO model introduced here quantifies that perceived benefit and numerically shows the cost savings in serving outdoor small cells via DOCSIS. This sort of use case strengthens our view that DOCSIS technology has a huge role to play in 5G deployments.

Subscribe to our blog and stay tuned as we continue to explore how to leverage DOCSIS network for mobile deployments. In our next blog post of this series, we intend to look at the DOCSIS networks’ ability to support advanced features such as CoMP.

Wireless

TCO of DOCSIS® Network XHaul vs. Fiber BackHaul: How DOCSIS Networks Triumph in the Indoor Use Case

In our recently published blog post, we demonstrated why indoor femtocells have reemerged as an attractive deployment model. In particular, indoor network densification has huge potential for converged cable/wireless operators who can leverage their existing Hybrid Fiber Coax (HFC) footprint to either backhaul from full-stack femtocells or fronthaul from virtual Radio Access Network (vRAN) remote radio units.

In the second blog in our series, we shift the focus from system level benefits to making the business case. As we walk through our TCO model, we will show a 40% to 50% reduction in Total Cost of Ownership (TCO) for an indoor deployment model served by DOCSIS networks compared to a more traditional outdoor deployment served by fiber. Yeah, that is big, so let’s break down how we got there.

Why DOCSIS Networks?

Before jumping into the TCO discussion, let’s revisit the key motivations for using DOCSIS networks as a tool for mobile deployments:

- Broad-based availability: In a Technical Paper prepared for SCTE-ISBE 2018 Fall Technical Forum, a major Canadian MSO pointed out that there typically is 3~5X more coax cable than fiber in its major metro markets. In the US too, per FCC’s June 2017 statistics, nation-wide cable Household Passed (HHP) stands at 85% (115M units), whereas fiber HHP stands at 29% (39M units)

- Gigabit footprint: As of June 2018, over 63% of US homes have access to gigabit service over cable. In other markets cable operators are pushing ahead with gigabit buildout as well

- Ease of site acquisition: No permitting, no make ready, limited installation effort.

- Evolving mobile-friendly technology: Ranging from latency optimization to timing/synchronization techniques and vRAN support for non-ideal fronthaul links like DOCSIS networks.

Scenarios We Looked At

For TCO comparison, we looked at the following 3 deployment scenarios:

Scenario 1: Outdoor small cell served by leased fiber backhaul

This is the traditional solution for deploying small cells. For our TCO model, we treated this as the baseline.

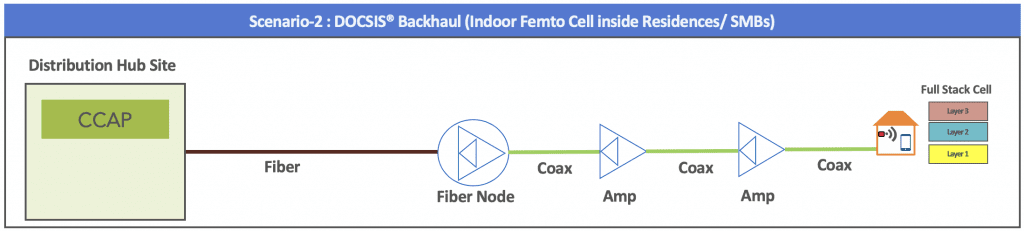

Scenario 2: Indoor femtocell/home eNodeB served by residential/SMB DOCSIS network links as backhaul.

In this scenario, we modeled the deployment of a full-stack femtocell in residential customer homes and small to medium businesses (SMB) served by the converged operator’s DOCSIS network. A converged operator here refers to a cable operator that deploys both DOCSIS network and mobile networks.

Scenario 3: Indoor vRAN Remote Radio Unit (RRU) served by residential/SMB DOCSIS network links as fronthaul

Scenario 3 is essentially scenario 2 but using vRAN. In this case, the virtual base band unit (vBBU) could be deployed on general purpose processors (GPP) servers in the distribution hub site with low-cost radio units deployed in DOCSIS gateways at the customer premise, or SMB location.

Apples to Apples

To build the TCO model, we start with a representative suburban/urban area we want to model. In our case, we used a 100 sq. km area with a total of 290k households (HH). At 2.4People/HH (the US average), our modeled area covered roughly 700K people.

Next, we considered that this area is already served by 10 outdoor macrocells, but the operator needs to boost capacity through network densification.

Under Scenario 1, the operator deploys 640 outdoor small cells that cut existing macro cells’ traffic load by half and boost the spectral efficiency (and therefore capacity) across the network. To create an apples-to-apples comparison of system capacity under all three scenarios, we applied the concept of normalized spectral efficiency (SE) and kept that consistent across the three scenarios. For SE normalization, we added up weighted SE for different combinations of Radio Location-User Location (e.g. In-In, Out-Out, Out-In) in each scenario.

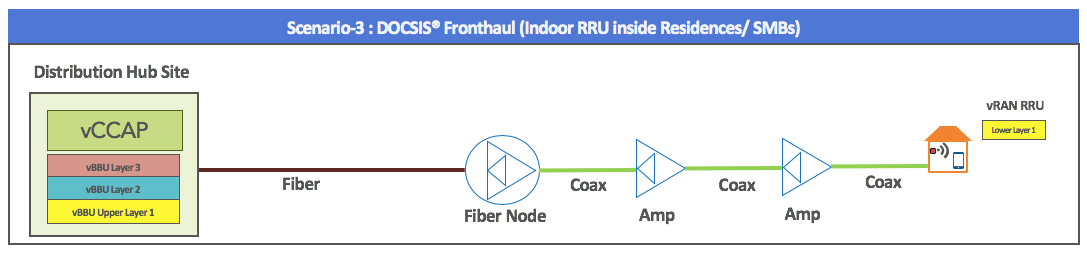

In the end, we used the normalized SE to find the appropriate scale for each scenario to achieve the same result at the system level, i.e. how many femtocells/vRAN radios will be required in indoor scenarios (2 & 3) so the system capacity gain is comparable to the traditional deployment in scenario 1.

Work Smarter, Not Harder

Crucially, converged operators know who their heavy cellular data users are and among them, who consistently use the network during non-business hours, i.e., most likely from their residences. As an example, a CableLabs member shared empirical data showing that the top 5% of their users consume between 25%~40% of overall cellular network capacity on a monthly basis.

So as a converged operator, if you want to prevent at least 25% of network traffic from traversing through walls, you can proactively distribute home femtocells or RRUs to only the top 5% of your users (assuming their entire consumption happens indoor).

In our model, we used the following approach to get the scale of indoor deployment for scenarios 2 and 3:

Figure-A: Determining Scale of Deployment for Indoor Use Cases

Therefore, theoretically, if only 2.5% of subscribers start using indoor cellular resources, we can achieve the same SE improvement in scenarios 2 and 3, as observed under scenario 1’s fiber outdoor deployment.

However, we know assuming 100% of heavy users traffic is consumed at home or indoors is unrealistic. To account for a combination of real-world factors including that indoor doesn’t mean only at your residences, that some of those heavy user locations may not be serviceable by a DOCSIS network, and/or some users may opt out from using a home femtocell/RRU we boosted that percentage of the subscriber base we modeled using femtocell/RRU deployments to 12.5% (or roughly 35K units) to make sure that we can definitely capture at least 12.5% of cellular traffic in scenario 2 and 3.

Our Analysis and Key Takeaways

For the TCO model assumptions, we gathered a wide range of input from a number of CableLabs operators and vendors. In addition, we validated our key assumptions with quite a few Telecom Infra Project (TIP) vRAN fronthaul project group’s members.

Though configurable in our model, our default TCO term is 7 years. Also, we calculated the TCO per user passed and focused on the relative difference among scenarios to de-emphasis the overall cost (in dollars), which will differ by markets, the scale of deployment and supplier dynamics among other things.

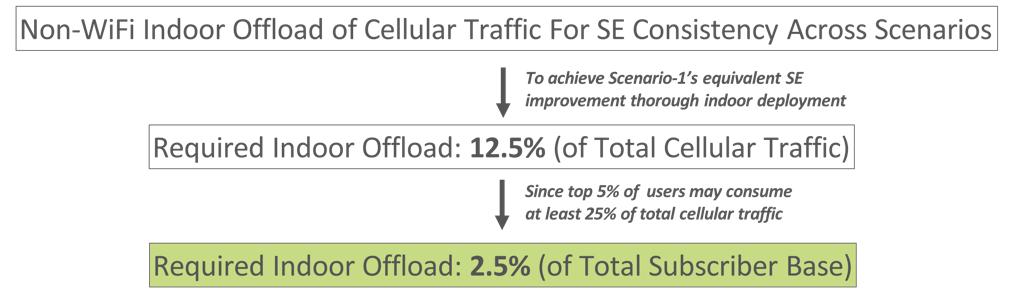

Figure-B: Summary of 7-Yr. TCOs across 3 Deployment Scenarios

According to our base case assumptions, we see the following:

- TCO in scenarios 2 and 3 can be around 40%~50% cheaper than the TCO in scenario 1.

- For scenario 1, Opex stands out as it involves large fees associated with outdoor small cell site lease and fiber backhaul lease.

- Scenario 2 commands a higher Capex than scenario 3, largely because of higher (~2X) unit price per full-stack home femtocell (vs. home RRU) and the need for security gateway, which is not required in scenario 3.

- Scenario 3’s Opex is nearly double (vs. scenario 2 Opex), as it requires a significantly higher DOCSIS network capacity for the upstream link. Yet, notably, despite the increased DOCSIS network capacity used by a vRAN deployment, the TCO is still the most favorable.

- We allocated 20% of DOCSIS network upgrade (from low split to mid split) cost to DOCSIS network-based use cases (scenarios 2 and 3). If we take those out (since DOCSIS network upgrades will happen anyway for residential broadband services) the TCO of these indoor use cases get even better compared to the fiber outdoor case (scenario 1).

- Other key sensitivities include monthly cost/allocated cost of the XHaul, number of small cell sites within a small cell cluster, radio equipment cost, and estimated number/price of threads required for vBBU HW to serve a cluster in the vRAN scenario.

In an upcoming strategy brief (CableLabs member operators only), we intend to share more details on our methodology, assumptions and breakdown of observed results (both Capex and Opex) along with a sensitivity analysis.

What Do These Results Mean?

To us, it was always a no-brainer that a DOCSIS network-based deployment would have favorable economics compared to a fiber-based model. The TCO model introduced here confirms and quantifies that perceived benefit and points out that for network densification, there is a business case to pursue the indoor femtocell use case where market conditions are favorable.

Subscribe to our blog because our exploration of DOCSIS networks for mobile deployments isn’t over. Coming up next we explore a similar TCO model focused on outdoor deployments served by DOCSIS backhual. Later we will shift back to technology as we look at the DOCSIS networks ability to support advanced features such as CoMP.